A resale certificate is an official document that easily instills confusion in many online resellers at the start. Depending on the state you live in, it can also be called a reseller’s permit, reseller’s license, reseller’s certificate, resale license, sales tax ID or sales tax permit.

Whatever you call it, it serves the same purpose – it helps you avoid paying tax that you do not need to pay. Needless to say, that makes it very important. The document works in favor of the reseller, which is why we, the 888 Lots team, require that you have one in order to do business with us.

What is a resale certificate?

Let’s start with what sales tax is. Sales tax is a form of tax collected by a governing body for the sales of certain goods. Each state has its own sales tax laws and therefore rates differ from state to state.

US-based resellers do not need to pay sales tax for the products that they purchase from wholesalers, for example, and sell to their customers. Instead, the sales tax is paid by the customers when they buy the product. The reseller collects the money and sends it to the state according to a predetermined schedule, usually monthly, quarterly or annually. In order to get exempt from paying sales tax when buying from 888 Lots, for instance, you need this license.

Sales tax nexus

A sales tax nexus “also known as sufficient physical presence, is the determining factor of whether an out-of-state business selling products into a state is liable for collecting sales or use tax on sales into the state”.

The term “sufficient physical presence” is what confuses most people and with reason – this rule can also vary between states. The simple rule to remember is that you have a nexus in a state if you do any of the following in that state:

- have an office

- have a warehouse

- have an employee

- have an affiliate

- store inventory

- temporarily do physical business – trade show, fair, etc.

- drop shipping from a 3rd party provider

The rule to abide by is that you should collect sales tax for a state if you have a nexus present there. Take a look at TaxJar’s extremely helpful list of states and see what creates a nexus in each.

As mentioned before, it is the customers who pay the sales tax. Just remember that you need to make sure you collect the correct amount of sales tax if you don’t want to be held accountable for the difference if you come up short. So, if you want to have sales tax under control, we’ve prepared for you 5 ways to save time and energy handling sales.

Now that we made things clear, the next question is…

Which state’s tax rates should you charge?

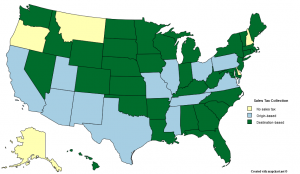

There are two types of states in this case – origin- and destination-based sales tax states. The name pretty much explains it. If you are located in an origin-based state you would collect sales tax at the rate of where your office/warehouse is (the origin of the sale). The sales tax could be the sum of state, county, city and district rates.

If you are located in destination-based state, you would collect sales tax at the rate of where the buyer is (the destination of the sale). The sales tax could be the sum of state, county, city and district rates.

Look at where you are located on the map to find out which type of tax you need to collect.

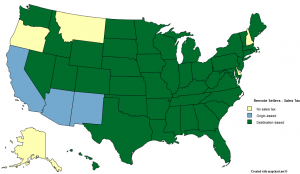

Things are a little different for Amazon FBA sellers. They are considered ‘remote sellers’. This is if you are based in one state but also have a nexus in another state, without being based there. This happens when you ship to Amazon FBA centers located in states other than where you are.

In this case, only 3 states are considered origin-based: Arizona, California and New Mexico.

In this set of Marketplace Sales Tax Collection rules, you need to look at the state of FBA center you ship to/from is located. Not where your business is located.

How to apply for a resale certificate?

So, how do you apply for such a certificate?

Let’s go through the process step-by-step!

Step 1: Figure out which states you need a Reseller’s Permit for

As mentioned previously, the laws vary from state to state. The best thing to do is turn to your local tax office or your lawyer.

By rule, you need a the permit for every case where you need to collect sales tax. You need to collect sales tax for every state where you have a nexus. So, accordingly, you need to have the according document for the state you are based in and every state that you ship inventory to Amazon Fulfillment centers.

Resale Certificates by States

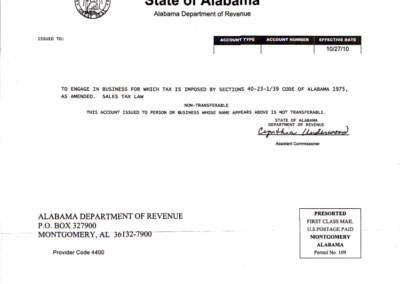

Resale Certificate for AlabamaIf interested, you can find applications for exemption and frequently asked questions at the Alabama Department of Revenue. Acceptable resale forms are the sales tax permit and form ST: EX -A1. Resellers who do not have a sales tax license may use the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations is 3 years from the due date or filing date, whichever is later. If more than 25% of the taxable amount is omitted, the statute of limitations is extended to 6 years. No statute of limitations occurs if no tax return is filed or if a fraudulent tax return is filed with the intent to evade taxes. |

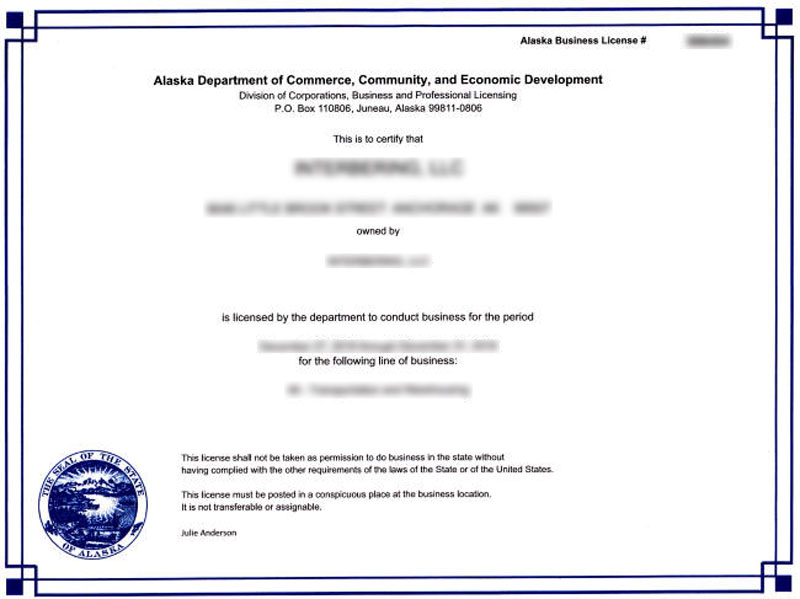

Resale License for AlaskaWhile Alaska does not impose a state sales tax, various local sales taxes apply in multiple jurisdictions. These taxes vary by municipality, and sales tax exemptions differ accordingly. To access detailed information about tax exemptions, consult the Tax Exemption Letter of Response. Moreover, exempt resellers are eligible to utilize the MTC Uniform Sales & Use Tax Resale Certificate. |

Resale Certificate for Arizona To learn more about sales tax exemptions in Arizona, refer to the TPT Exemptions page provided by the Arizona Department of Revenue. Valid resale forms include Resellers Form 5000A and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax-related matters is 4 years from the due date or filing date. If more than 25% of the taxable base is omitted, the statute of limitations is extended to 6 years. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with the intent to evade taxes. |

Resale Certificate for ArkansasGain insights into sales and use tax exemptions through the Sales and Use Tax FAQs in Arkansas. Acceptable forms for exemption include Exemption Certificate ST-391 and SST Certificate of Exemption. Additionally, the MTC Uniform Sales & Use Tax Resale Certificate is applicable. The statute of limitations for tax-related issues is 3 years from the due date or filing date. Furthermore, it can be extended to 6 years if omissions in taxable base exceed 25%. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for CaliforniaFor comprehensive guidance on sales and use tax matters in California, access the Sales and Use Tax links provided. Approved exemption forms include General Resale Certificate CDTFA-230 and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax-related concerns is 3 years from the end of the assessed quarter or filing date, extended to 8 years if over 25% of the taxable base is omitted. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for ColoradoAccess detailed information about sales tax in Colorado through the Sales Tax Guide. Valid exemption forms encompass Multijurisdiction Sales Tax Exemption Certificate DR 0563 and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax matters is 3 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for ConnecticutTo gain insights into sales and use tax exemptions in Connecticut, explore the Sales and Use Tax information. Accepted exemption forms include the Connecticut Sales & Use Tax Resale Certificate and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax-related issues is 3 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for DelawareNotably, Delaware does not impose a state sales tax; hence, exemption certificates do not apply. |

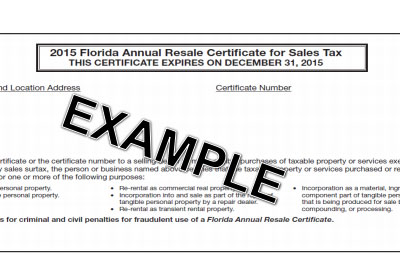

Resale Certificate for FloridaFor quick reference regarding sales tax matters in Florida, consult the Resale Certificate and Government Exemptions resources. Accepted exemption forms encompass the Annual Resale Certificate and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax concerns is 3 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

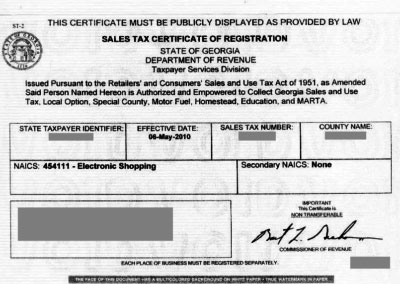

Resale Certificate for GeorgiaComprehensive information about sales tax in Georgia can be accessed through Sales Tax FAQs. Accepted exemption forms include the MTC Uniform Sales & Use Tax Resale Certificate and the SST Certificate of Exemption. The statute of limitations for tax-related matters is 3 years from the due date or filing date. Also, you can extend to 6 years if over 25% of the taxable base is omitted. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Tax License for HawaiiDetails about General Excise and Use Tax are available in the General Excise and Use Tax Information. Acceptable exemption forms include Resale Certificate General Form 1, Resale Certificate General Form 2, Resale Certificate Special Form, in addition to the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax matters is 3 years from the due date or filing date. The statute of limitations does not apply when a taxpayer fails to file a return or files a fraudulent return with intent to evade taxes. |

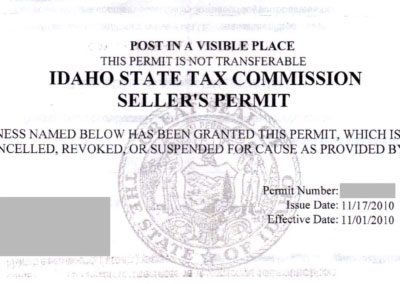

Seller’s Permit for IdahoFor general exemption information, refer to the Accepted Exemption Forms resource. Valid forms include Sales Tax Resale or Exemption Certificate Form ST-101 and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax concerns extends to the most recent 3 years of business, or the most recent 7 years if a permit isn’t held or regular filing hasn’t occurred. The statute of limitations does not apply when a taxpayer fails to file a return or files a fraudulent return with intent to evade taxes. |

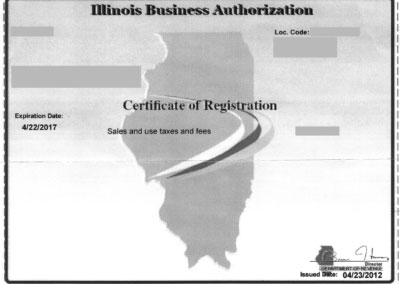

Resale Certificate for IllinoisComprehensive details about sales tax in Illinois can be found in the Certificate of Resale Form CRT-61 and MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax issues is 3 years from the due date or filing date. The statute of limitations does not apply when a taxpayer fails to file a return or files a fraudulent return with intent to evade taxes. |

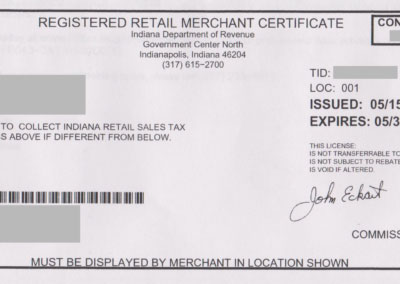

Resale Certificate for IndianaFor valuable insights into sales tax in Indiana, access the Sales Tax FAQ. Accepted exemption forms encompass General Sales Tax Exemption Certificate Form ST-105, Dealer-to-Dealer Resale Certificate Form ST-105D, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax matters is 3 years from the due date or filing date. The statute of limitations does not apply when a taxpayer fails to file a return or files a fraudulent return with intent to evade taxes. |

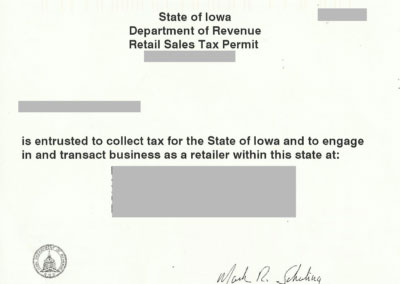

Retail Sales Tax Permit for IowaTo navigate the intricacies of sales and use tax in Iowa, explore the Sales and Use Tax Guide. Accepted exemption forms include the Iowa Tax Exemption Certificate Form 31-014, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax concerns is 3 years from the due date or filing date. Furthermore, it can be extended to 6 years if the return lacks items of gross income defined in the Internal Revenue Code. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

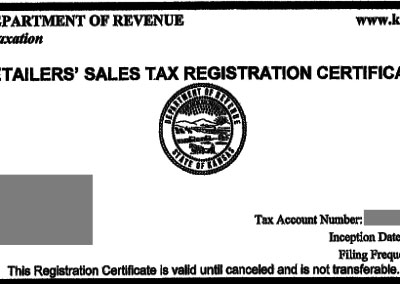

Sales Tax Certificate for KansasFor a deeper understanding of sales tax in Kansas, refer to the Sales Tax FAQ and the Exemption Certificate Booklet. Accepted exemption forms consist of the Resale Exemption Certificate Form ST-28A, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax issues is 3 years from the filing date. The extension is 6 years if the return lacks items of gross income defined in the Internal Revenue Code. If a fraudulent return is filed with intent to evade taxes, the limitation is 2 years from the discovery of the fraud. |

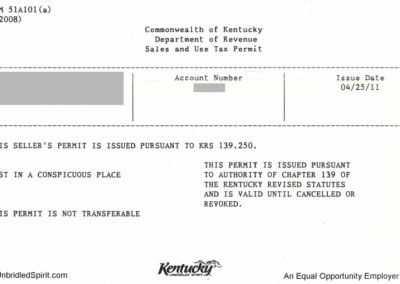

Resale Certificate for KentuckyDetailed information about sales tax in Kentucky can be found in the Sales Tax Information resource. Accepted exemption forms include the Resale Certificate Form 51A105, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax concerns is 4 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for LouisianaFor insights into sales tax matters in Louisiana, consult the Sales Tax FAQ and Resale Certificate FAQ. Accepted exemption forms encompass the Resale Certificate Application. The statute of limitations for tax issues is 3 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

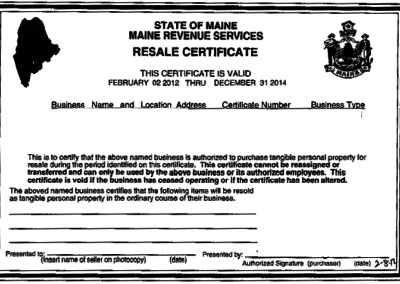

Resale Certificate for MaineTo access detailed information about sales tax in Maine, explore the Sales Tax Guide. Accepted exemption forms include the Resale Certificate and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax concerns is 3 years from the due date or filing date, extended to 6 years if the reported tax is less than 50% of the tax due. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for MarylandFor Resale Certificate FAQs, refer to the relevant resources. Accepted exemption forms include the Recommended Form Resale Certificate and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax matters is 3 years from the due date. No statute of limitations applies if no return is filed. Also, other cases are if the return is underpaid by 25% or more, or if a fraudulent return is submitted with intent to evade taxes. |

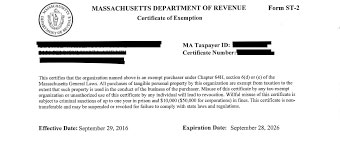

Resale Certificate for MassachusettsAccess the Sales and Use Tax Guide for comprehensive guidance. Accepted exemption forms include the Resale Certificate Form ST-4. The statute of limitations for tax concerns is 3 years from the due date, extended to 6 years in case of massive underpayment or late returns. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for MichiganExplore Exemptions FAQ for detailed information about sales tax in Michigan. Accepted exemption forms encompass the Sales Tax Resale and Exemption Certificate Form 3372, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax issues is 4 years from the due date or filing date, extended to 6 years if the return lacks items of gross income defined in the Internal Revenue Code. If a fraudulent return is submitted with intent to evade taxes, the limitation is 2 years from the discovery of the fraud. |

Resale Certificate for MinnesotaRefer to the Exemptions FAQ and Retailers and Wholesalers Industry Guide for valuable insights into sales tax in Minnesota. Accepted exemption forms include the Exemption Certificate Form ST3, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax concerns is 3.5 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for MississippiExplore Exemption Information and Sales Tax FAQ for detailed insights into sales tax in Mississippi. Mississippi does not issue resale exemption certificates. Goods for resale can be purchased tax exempt using a valid sales tax permit. The statute of limitations for tax concerns is 3.5 years from the due date or filing date, extended to 6.5 years if underpaid by more than 25%. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for MissouriFor information about exemptions in Missouri, visit the Exemption Information Search Hub and Sales Tax Exemption FAQ. Accepted exemption forms include the Exemption Certificate Form 149 and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax issues is 3 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

Resale Certificate for MontanaMontana does not impose a state sales tax, thus exemption certificates are not applicable. |

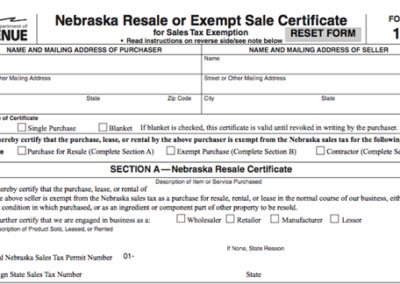

Resale Certificate for NebraskaRefer to the Sales Tax FAQ for insights into sales tax matters in Nebraska. Accepted exemption forms encompass Resale or Exempt Sale Certificate Form 13, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax issues is 3 years after the last day of the month following the determination period or after the return is filed, whichever is later. If there’s an underpayment or no return is filed, the limitation is extended to 8 years. No statute of limitations applies if a fraudulent return is submitted with intent to evade taxes. |

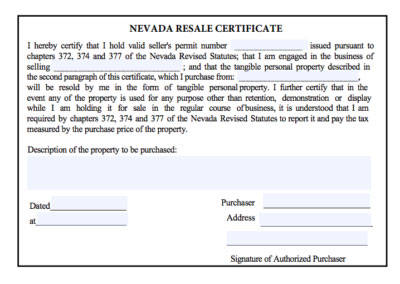

Resale Certificate for NevadaFor comprehensive information about sales tax in Nevada, refer to the Sales Tax FAQ. Accepted exemption forms include the Resale Certificate, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax concerns is 3 years after the last day of the month following the determination period or after the return is filed, extended to 8 years if no return is filed, a fraudulent return is submitted with intent to evade taxes, or there’s an underpayment of more than 25%. |

Resale Certificate for New HampshireNew Hampshire does not impose a state sales tax, thus exemption certificates are not applicable. |

Resale Certificate for New JerseyFor comprehensive information about sales tax in New Jersey, access Sales Tax Information and Sales Tax Exemption Administration Bulletin. Accepted exemption forms include the Resale Certificate Form ST-3 and Resale Certificate for Out-of-State Sellers Form ST-3NR, as well as the MTC Uniform Sales & Use Tax Resale Certificate and SST Certificate of Exemption. The statute of limitations for tax issues is 4 years from the filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with intent to evade taxes. |

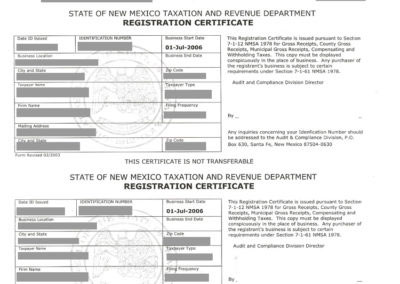

Resale Certificate for New MexicoGain comprehensive insights into New Mexico’s sales tax regulations by referring to the Non-Taxable Transaction Certificates (NTTCs) and the Gross Receipts Tax Overview. You’ll find detailed information on accepted exemption forms, including the Non-Taxable Transaction Certificate Type 2, Resale Certificate Type 5, Border States Resale Certificate, Out-of-State Resale Certificate Type NTTC-OSB, and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax concerns is 3 years from the close of the year in which the filing was due. If an underpayment of over 25% occurs, this limitation extends to 6 years. Furthermore, if no return is filed, the limitation period is 7 years. However, no statute of limitations applies if a fraudulent return is submitted with the intent to evade taxes. |

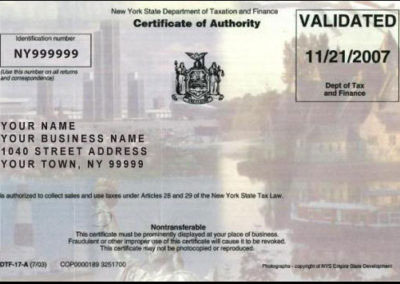

Resale Certificate for New YorkDelve into information about exemption certificates by accessing the Accepted Exemption Forms resource. The Resale Certificate Form ST-120 is a valid form for exemption. The statute of limitations for tax issues is 3 years from the filing date. No statute of limitations is applicable if no return is filed or if a fraudulent return is submitted with the intent to evade taxes. |

Resale Certificate for North CarolinaObtain comprehensive insights into North Carolina’s sales tax regulations through the Sale and Purchase Exemptions and Sales and Use Tax Information resources. Among the accepted exemption forms are the MTC Uniform Sales & Use Tax Resale Certificate and the SST Certificate of Exemption. The statute of limitations for tax concerns is 3 years from the due date or filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with the intent to evade taxes. |

Resale Certificate for North DakotaAccess detailed guidance on North Dakota’s sales tax regulations by referring to the Sales and Use Tax Information. Accepted exemption forms include Resale Certificate Form SFN 21950 (11-2002), the MTC Uniform Sales & Use Tax Resale Certificate, and the SST Certificate of Exemption. The statute of limitations for tax issues is 3 years from the due date or filing date, extending to 6 years if no return is filed or if an underpayment of more than 25% occurs. No statute of limitations applies if a fraudulent return is submitted with the intent to evade taxes. |

Resale Certificate for OhioFor Sales Tax FAQ and Applying Sales Tax FAQ, refer to the relevant resources. You can find approved exemption forms like the Single Purchase Exemption Form STEC U, Exemption Certificate Form STEC B, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax concerns is 4 years from the due date or filing date. There’s no statute of limitations if no return is filed. |

Resale Certificate for OklahomaFind Sales Tax Information in the relevant resources. Accepted exemption forms include the MTC Uniform Sales & Use Tax Resale Certificate and SST Certificate of Exemption. The statute of limitations for tax issues is 3 years from the filing date. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with the intent to evade taxes. |

Resale Certificate for OregonPlease note that Oregon does not impose a state sales tax, hence exemption certificates are not applicable. |

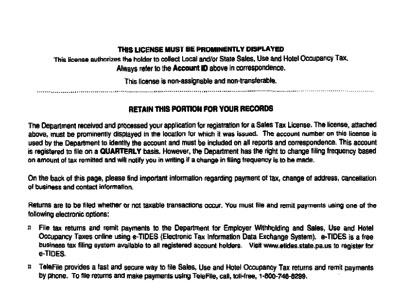

Resale Certificate for PennsylvaniaGain comprehensive insights into sales tax in Pennsylvania by referring to the Retailers Information Guide and Sales Tax Information. Accepted exemption forms encompass the Approved Industry and Resale Exemption Certificate Form REV-1220 and the MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax concerns is 3 years from the filing date or the close of the year in which taxes are due. No statute of limitations applies if no return is filed or if a fraudulent return is submitted with the intent to evade taxes. |

Resale Certificate for Puerto RicoFind Sales Tax Information and Reseller Information by referring to the relevant resources. Accepted exemption forms include the Exemption Certificate Form AS 2916.1. The statute of limitations for tax issues is 4 years from the filing date or the close of the year in which taxes are due, whichever is later.

|

Resale Certificate for Rhode IslandAccess comprehensive information about tax-exempt organizations and Sales Tax FAQs through the Rhode Island Department of Revenue. Approved exemption forms consist of the Resale Certificate, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statutory time limit for tax matters is 4 years from the date of filing or the end of the tax year in question, whichever is later. No time limit applies if no tax return is submitted or if a fraudulent return is filed with the intention of evading taxes.  |

Retail License for South CarolinaDelve into Retailers’ Information to understand the intricacies of sales tax exemptions in South Carolina and FAQ. Valuable insights can also be gleaned from the Resale Certificate Information. Approved exemption forms encompass the Resale Certificate Form ST-8A and MTC Uniform Sales & Use Tax Resale Certificate. Also, the statute of limitations for tax matters spans 4 years from the due date or filing date. No limitations exist if no tax return is filed or if a fraudulent return is submitted with the intention to evade taxes.  |

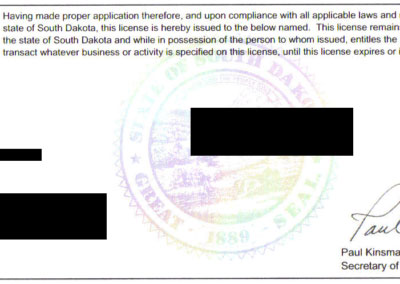

Resale Certificates in South DakotaObtain detailed guidance on sales tax in South Dakota by referring to the Sales and Use Tax Guide and Exemption Certificate Information. Acceptable exemption forms include the document, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statutory limitation for tax concerns extends to 3 years from the due date or filing date. The statute of limitations does not apply when a taxpayer fails to file a return or files a fraudulent return with intent to evade taxes. |

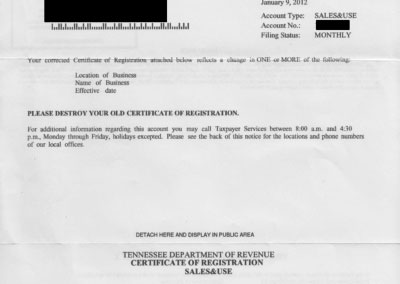

Resale Certificate for TennesseeGain comprehensive insights into sales tax matters in Tennessee by accessing the Sales Tax Guide and Retailers’ Guide to Sales Tax Exemptions. Accepted exemption forms encompass the Resale Certificate, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax issues is 3 years from the due date or filing date. The statute of limitations does not apply when a taxpayer fails to file a return or files a fraudulent return with intent to evade taxes. |

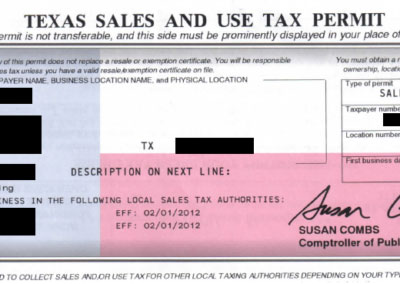

Sales and Use Tax Permit Requirements in TexasUncover Sales Tax FAQs and the Exemption Certificate Search to address sales tax queries in Texas. Approved exemption forms include the Resale certificate | Form 01-339 , MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax concerns spans 4 years from the due date or filing date. No limitations exist if no return is filed or if a fraudulent return is submitted with the intention of evading taxes or there’s an underpayment of more than 25%. |

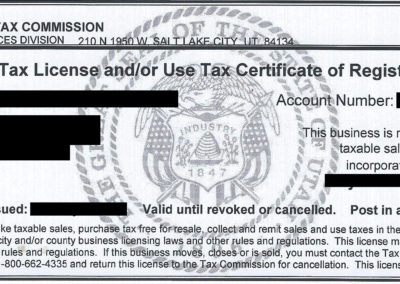

Resale Certificate Protocol in UtahAccess the Sales Tax FAQ and Exemption Certificate Information for in-depth insights into sales tax matters in Utah. Recognized exemption forms comprise the Resale Certificate Form TC-721, MTC Uniform Sales & Use Tax Resale Certificate, and SST Certificate of Exemption. The statute of limitations for tax issues is 3 years from the due date or filing date. The statute of limitations does not apply when a taxpayer fails to file a return or files a fraudulent return with intent to evade taxes. |

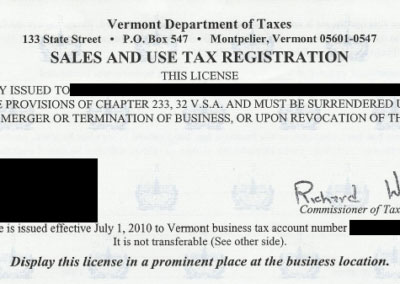

Resale Certificate Guidelines in VermontRefer to the Sales and Use Tax Information for a comprehensive understanding of sales tax regulations in Vermont. Accepted exemption forms include the Resale Certificate Form S-3, SST Certificate of Exemption and the MTC Uniform Sales & Use Tax Resale Certificate.</span> The statute of limitations for tax concerns extends to 4 years from the due date or filing date. No limitations apply if no return is filed or if a fraudulent return is submitted with the intention of evading taxes. |

Reseller Permit for Washington, D.C.Explore Exemption FAQ for a comprehensive understanding of sales tax matters. Approved exemption forms include the Reseller Permit Form OTR-368. The statute of limitations for tax issues extends to 4 years from the issued. No limitations apply if no return is filed or if a fraudulent return is submitted with the intention of evading taxes. |

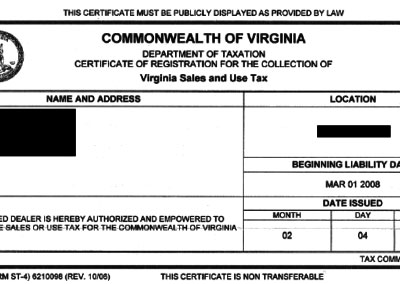

Resale Certificates in VirginiaGain comprehensive insights into sales tax matters in Virginia through the Sales and Use Tax Guide, Sales Tax FAQs, and Accepted Exemption Forms. Approved exemption forms comprise the Resale Certificate and MTC Uniform Sales & Use Tax Resale Certificate. The statute of limitations for tax concerns is 4 years from the due date or filing date. No limitations apply if no return is filed or if a fraudulent return is submitted with the intention of evading taxes.  |

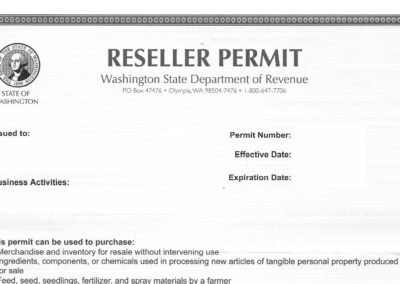

Resale Certificate for WashingtonExplore Sales Tax Information and Accepted Exemption Forms for a comprehensive understanding of sales tax matters. Approved exemption forms include the Resale Certificate and MTC Uniform Sales & Use Tax Resale Certificate and SST Certificate of Exemption. The statute of limitations for tax issues extends to 4 years from the close of the year of the certificate’s issue. No limitations apply if no return is filed or if a fraudulent return is submitted with the intention of evading taxes. |

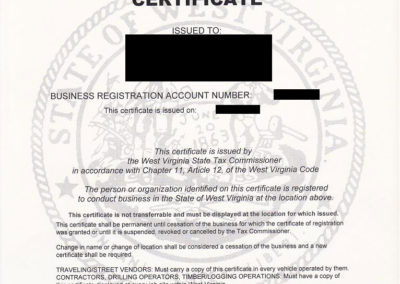

Resale Certificate in West VirginiaGain comprehensive insights into sales tax in West Virginia by accessing Sales and Use Tax Information. Approved exemption forms encompass SST Certificate of Exemption. The statute of limitations for tax concerns extends to 3 years from the close of the year of issuing the document. There can be an extension to 6 years. No limitations apply if you don’t have a filed return. Another case is if a fraudulent return is submitted with the intention of evading taxes.  |

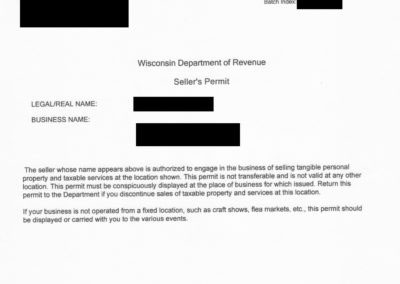

Seller’s Permit Guidelines in WisconsinRefer to Sales and Use Tax Information for detailed guidance on sales tax matters in Wisconsin. Approved exemption forms comprise the Seller’s Permit Form S-211, Form S-211E, MTC Uniform Sales & Use Tax Resale Certificate, SST Certificate of Exemption. |

Tax License for WyomingFor Sales Tax Information and Exemption Certificate Information, refer to the relevant resources. Approved exemption forms include the Resale Certificate EST Form 101, SST Certificate of Exemption. |

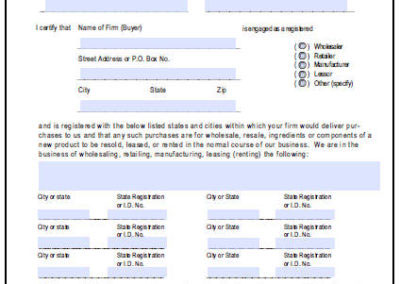

Step 2: Prepare the documents you need to register for a sales tax permit</strong>

Depending on the state you’re applying for, you may be asked to provide some personal data and different type of information related to your business. If you’re curious to discover what documents you need to prepare, TaxJar’s article explains how you can register for sales tax permit in every state.

Step 3: Fill out your application

Alright! Now that you’ve collected the information you need, you’re ready to apply for your reseller’s permit. In fact, you can do it either online or in person. As we already mentioned, you need to apply in all of the US states where you run a business. Also, you should be aware that you’ll probably have to pay a small fee to file your application.

For more information on how to get a this document, consult your local state department.

Do you have to renew your sales tax permit?

In conclusion, some of these states require you to renew your certificate after a certain amount of time, while others do not. TaxJar has an extensive and very useful list with all the information.

We have compiled all the needed information and resources for acquiring a resale certificate. At 888 Lots we require a valid resale certificate from the state you are located in. We will keep your certificate on file after your first purchase. In this way, you do not need to present it every time. For any additional questions, don’t hesitate to reach out at marketing@888digital.com We are always ready to support your business journey and we look forward to having you as our customer.